Tax On TPD Payouts

Around 9 million Australians own Total and Permanent Disability (TPD) insurance, most of whom obtain it through their superannuation fund. TPD insurance generally pays the insured a lump sum benefit should the person be injured or critically ill and unlikely to ever work again. However, the common question is, how much do you owe the taxman?

Is a TPD payout taxable?

A TPD insurance lump sum payout made outside of superannuation is typically tax-free and is not considered income. However, where a TPD payout is made through super, there are several factors you need to consider as your benefits may be taxed.

Is your payout lump sum or an income stream? Is it paid to super or directly to you?

Lump Sum Payout

When accessing a TPD lump sum payout that has been received through super, there may be an element of taxation. Essentially, superannuation balances are comprised of tax-free and taxable components which materially impact the net benefit you will receive upon withdrawal. Your Super Fund should be able to provide you with precise figures relating to the breakdown of your fund, enabling you to better understand your tax liabilities. You may read more about the details from the Australian Tax Office website here.

Where your policy is held in your own name and paid directly to you, it is unlikely that you have a tax liability however you should consult a tax advisor to confirm this.

Income Stream Payout

TPD payouts that are paid as an income stream, it can be deemed as taxable income. You may be eligible to receive an offset on the taxable component of the income stream which reduces your tax liability however you will need to consult a licensed tax advisor to confirm how this will apply to you.

Once you receive your TPD payout, you have a few options on what to do with your benefit. Check out our guide here on what to do with your TPD payout.

What tax will you pay on a TPD payout?

The rate of tax typically applied to the taxable component of your TPD payout will be 22%. This assumes that you are under preservation age which is common among those receiving such payouts. The amount of tax you will pay is entirely dependant on your own circumstances which makes it crucial that you seek advice when determining this amount.

What is the percentage of TPD taxed on your payout?

Knowing how much you owe in taxes for your TPD payouts is important as it will affect how much you can take home and spend for your needs.

Here’s a quick guide you can use to give you an idea of how much tax you should pay for TPD payouts within your super.

If a person is above the preservation age (55-60), lump sum withdrawals shall be tax-free and withdrawing as an income stream could also be tax-free depending on the taxable portion of your superannuation balance.

For a person who is below the preservation age, lump sum withdrawals can be taxed of up to 22% while income stream withdrawals will be taxed at each individual’s marginal tax rate less 15% tax offset.

Calculating the tax on TPD payout can be a bit overwhelming. If you need an expert to work with you on this, talk with our TPD Insurance Claims Advisers today.

How to reduce your TPD tax?

Lower tax being imposed on a TPD payout means more funding for your needs. Below are four ways on how a person can minimise their tax obligations when receiving a TPD payout legally.

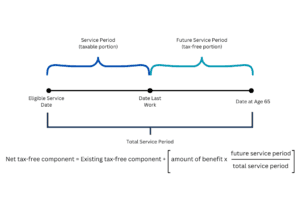

- Understanding the Tax-Free Uplift – if you withdraw your payout through your super account, there’s a tax-free uplift calculation that may substantially lower your taxed amount.

- Know the right time to withdraw – You may not be compelled to withdraw your payout immediately and you may have numerous options available to you. Understanding these options, in full, can result in better outcomes for your circumstances.

- Consider the Income Stream option – for people who are under the preservation age, having your TPD payout in an income stream option may lower your tax rather than having it in a lump sum.

- Get help from a professional – navigating your TPD insurance payout, superannuation and taxes could get you lost and confused. An expert adviser can guide you through the process, providing you with security and comfort.

Guide to how TPD tax is calculated

Learn how your TPD tax is calculated in relation to the tax-free uplift. Below is a guide illustration that you can follow.

What to know about calculating TPD tax

When making a TPD payout withdrawal on your super account if you’re below the preservation age, you need to have these information available.

- Your date of birth – in order to get your preservation age.

- Eligible Service Date – this is when your superannuation account was created. In case you managed to combine multiple superannuation accounts, you need to consider the earlier eligible service date.

- Date Last Worked – this pertains to the date of your termination from your employer, not the date of having been diagnosed with your medical condition or disability.

Common problems with TPD tax calculations

When dealing with TPD tax calculations, it is very common that one might get it wrong if one tries to calculate it themselves. Here’s a list of common problems others have faced.

- Misinterpretation of the Tax-free component – most people are incorrectly computing the tax-free portion of their TPD payout

- Incorrect Tax Withholding – there are cases of super funds withholding incorrect amounts of taxes resulting in over or underpayment

- Obsolete information on Tax Laws and Regulations – when navigating your way in taxes, one must make sure that the knowledge and information about the matter is up to date as the rules and regulations in taxes are subject to change

- Not aware of Income Stream Option – receiving the TPD payout as an income stream can be advantageous for tax purposes

Do-It-Yourself Approach – getting your taxes right saves you money but will cost you greatly should you fail. Getting help from financial professionals will not only save you money but time as well. Get in touch with our TPD Insurance Claims Advisers today.

What if there was a TPD calculation error

In the event of being overtaxed, your TPD tax calculation is probably where the problem started. Either you or your super fund might have used the wrong date for your last work. Double-check your calculation or have a financial expert look at it for you.

Our TPD Tax Calculator Tool might give you an idea of your tax dues.

The Superannuation Preservation Age

Knowing the preservation age is important as it will greatly affect your tax dues once you reach your preservation age.

| Date of Birth | Preservation Age |

|---|---|

| Before 1 July 1960 | 55 |

| 1 July 1960 – 30 June 1961 | 56 |

| 1 July 1961 – 30 June 1962 | 57 |

| 1 July 1962 – 30 June 1963 | 58 |

| 1 July 1963 – 30 June 1964 | 59 |

| From 1 July 1964 | 60 |

Do TPD payouts impact Centrelink payments?

TPD payouts can affect your centrelink payments as it may reduce the amount once you withdraw from your superannuation funds. Centrelink takes into consideration the individual’s current financial status if you’re eligible and the amount of payment. You may read our separate guide on affects of TPD payout here.

How Curo can help lower the tax burden of your TPD payout

Our team has decades of knowledge and expertise in the industry which allowed us to navigate the complexities of taxes. This is our way of looking out for our clients and because this is what matters in what we do.

Talk to our team of TPD Insurance Claims Advisers today and we will work with you so that you can get the most out of your insurance when you need it the most. Send us a message here.

Frequently asked questions

Is a TPD payout taxable?

This depends on whether you obtain your TPD insurance from an independent insurer. This is usually tax-free as its payout is not considered as income. However, should the payout be from your super account, several factors can make a portion of your withdrawal taxable between 18% – 1%.

How much tax will I pay on my TPD payout?

The standard marginal income tax rate is 22%. However, with the tax-free uplift calculation, your tax due can decrease between 18% – 1%.

How much is a lump sum payout for TPD?

There are several factors that can determine your TPD payout such as insurance coverage, income, and level of disability.

What happens after a TPD payout?

Upon receiving your TPD payout, you have the following options.

- Withdraw a lump sum amount or partial withdrawal

- Use your super balance to have an income stream option

General Advice Disclaimer: The advice provided is general advice only and in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.