TPD Insurance Claims Advice

Getting approved for a Total and Permanent Disability (TPD) Insurance Claim can be a significant financial event in your life. Having access to expert TPD claims advice will increase your chance for a successful claim.

Aside from the hardships that may result from the physical limitations caused by being disabled, dealing with the financial impact is also challenging. Loss of income to support living expenses, home modifications, and medical expenses can pile up and drain your savings.

This article is a comprehensive guide to help you in processing a TPD claim.

Why Do You Need A TPD Claims Expert

Lodging a TPD claim can be done individually, however, this strategy often has a lower rate of approval due to several factors such as not enough medical data to support the claim and not accurately following the highly detailed process prescribed by the insurer and super fund.

This is why working with a TPD Claims Expert such as our team at Curo Financial, is highly beneficial. Aside from our proven process when filing for a claim, we work closely with our clients to accomplish every requirement needed by the insurer.

From documentation, preparing of application form and supporting letter, to following up with the insurer, our team will be present.

As a bonus, our team of experts can provide financial advice on what to do after getting approved for the claim to help save on taxes and lessen the impact on Centrelink payments.

Who is covered in a TPD claim?

In general, TPD insurance can provide a lump sum benefit to an individual who is :

- Unable to perform the main duties in your current job.

- Unable to work in any job that you are suited to by way of education, training, experience or reasonable retraining.

- Having a severe medical condition that is preventing you from working permanently.

Reviewing the details of the TPD insurance policy will help you understand whether you are eligible for a TPD claim as different insurance providers can have different requirements and exclusions.

What are the requirements for a TPD claim?

Every insurance provider has a different set of requirements that need to be met to process a TPD claim. Below are common requirements that can be prepared in advance:

- Total and Permanent Disability: To be identified as disabled preventing an individual from working for life.

- Complete Medical Evidence: Proper documentation of all medical reports and results that support the disability. This must also contain the impact of the medical condition towards being permanently disabled, preventing the individual from performing work.

- Application Form: Insurers have different application forms. Make sure that your application form is updated and take time to fill out all the details needed.

- Supporting Letter: Writing a customised and personalised supporting letter detailing how your medical condition supports the TPD requirements will have a higher chance of approval.

Working with a TPD Claims Expert can help you with all these requirements.

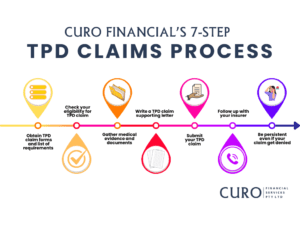

The TPD Claims Process: How to claim TPD insurance

The process for successfully claiming your TPD insurance varies from insurer to insurer.

However, the typical process goes as follows:

- Obtain TPD claim forms and a list of requirements

- Check your eligibility for TPD claim

- Gather medical evidence and documents

- Write a TPD claim supporting letter

- Submit your TPD claim

- Chase your insurer

- Be persistent even if your claim gets denied

As previously mentioned, every insurance provider has a different claims process. Our team at Curo Financial can help you with every stage of the process and what needs to be done in between. Our detailed TPD Claims Process works with every insurer in Australia no matter how complex the situation is. Send our team a message to start processing your claim.

As specialist insurance advisers, we understand TPD insurance intimately and have developed relationships with senior claims managers at many different insurers. Due to these relationships, we often have the ability to escalate claims issues within an insurer and super fund to achieve an expedited outcome.

All you need to know about TPD insurance coverage

TPD Insurance in Australia typically covers a range of medical scenarios. Below are some of the common examples:

Physical Illness: Heart conditions, cancer, stroke, respiratory diseases, neurological disorders, musculoskeletal disorders, kidney and liver disease, and others.

Injury: Musculoskeletal issues such as problems with your back or knees, Traumatic injuries, surgical complications, neurological injuries, and loss of limbs.

Mental Illness: Depression, anxiety disorders, post-traumatic disorder, bipolar disorder, and schizophrenia.

Different insurance providers have different sets of medical conditions that are covered. It is best to ask your insurer to verify if your condition is covered or work with a TPD claim expert.

As for the TPD payout, it will depend on the insurer and the claim will be assessed based on the type of policy. Please note that the definitions are general in nature and vary greatly between insurers.

- OWN OCCUPATION – often means you are unable to perform the specific job you had prior to the disability. This type of policy will have higher premiums and is usually obtained outside of super.

- ANY OCCUPATION – often means you are unable to work in any job in which you are suitably qualified and skilled based on your education, experience, and training. This is a more affordable policy option, however, the threshold for a claim is higher.

Superannuation VS Retail Insurance Provider

| SUPERANNUATION | RETAIL INSURANCE PROVIDER | |

|---|---|---|

| Affordability | Offers tax benefits on premiums paid | Not tax deductible resulting in higher premiums |

| Coverage | Superfunds have automatic TPD coverage | The amount of coverage, waiting period, and exclusions can be tailored depending on the needs. |

| Flexibility | Limited control as it is offered as a standard product inside a super fund | Customisable based on financial needs and situation |

| Claims Process | Longer process due to multiple parties involved | Easier and quicker to process claims |

What to do after you’ve submitted a TPD claim

While waiting for the approval of the TPD claim which can take several weeks or months, an individual can work on the following steps to maximise the benefit.

- Assess your financial situation – get an insight into your income sources (TPD payout, government benefits, and others), living expenses (housing, food, medical bills, utilities, and transportation), and your debt (outstanding mortgages, loans, and credit card balances) will help you plan your financial stability during challenging times.

- Know the impact of taxes on your TPD payout – computing how much you will need to pay on taxes once you withdraw your TPD payout is important as it will shrink your benefit amount. Our guide to tax on tpd payouts can help you.

- Determine if your Centrelink payments are affected – Centrelink payments for people with disability undergo a series of income and asset tests. These determine how much Disability Support Pension (DSP) they will receive.

- Create a financial plan – once you have an overview of all the information above, creating a financial plan that works with your current financial and medical situation to support your lifestyle is crucial. Your TPD claim won’t last long if not used properly.

- Work with a financial advisor – need help in managing your TPD payout? Working with a TPD claims expert such as Curo, can also help you manage your payout wisely.

The amount you can receive through a TPD claim

How much you get from your TPD claim will depend on the following factors:

The amount you receive from a claim, prior to any applicable fees and taxes, is typically the sum insured that applies to your cover on the date of disability. Generally, the date of disability is defined as the date you suffered the illness or injury that rendered you unable to work again. If your condition does not initially prevent you from stopping work but later does, the date of disability will generally be when you were no longer able to work. Your super fund or insurer should be able to confirm the amount of cover you had on the date of disability.

Aged-based or Specifed Cover is a nuance that often applies to default superannuation insurance:

There are two types of insurance coverage for TPD insurance policies under superannuation.

- Age-based cover – this type of TPD insurance takes your age into consideration when calculating your benefit amount. The older an individual gets, the lesser the amount of benefit.

- Specified cover – this type of insurance covers a specific amount of insurance coverage that can be obtained directly by contacting your super fund. The TPD benefit for this can reduce as the individual ages or increase based on the Consumer Price Index (CPI), or it can stay the same.

Taxes:

Lump sum payment from a TPD insurance claim is normally tax-free. However, once withdrawn from your super account, lump sum withdrawals can be taxed of up to 22%, if under preservation age. We have an article that can help you compute how much is your tax on your TPD payout.

How to handle a rejected TPD claim?

TPD claim rejected? Don’t lose hope yet. You can implement the steps below to re-appeal your TPD claim.

- Appeal the decision – upon receiving the rejection letter, it is common for insurance providers to have a 21-day window for any appeal of the decision. In the appeal, what you need to provide is a letter containing documents that will support your claim.

These documents can include, further medical documents, employment records, or character references that will signify your medical condition.

- Directly negotiate with the insurer – directly negotiating with your insurer to dispute the decision is also an available course of action for individuals with rejected TPD claims. However, this could be a daunting task for an average person.

- Take legal action – with the right help from professionals such as solicitors, you may recourse to taking the matters legally. However, aside from the daunting tasks waiting for you, you are also exposing yourself to high legal fees without any assurance of getting approved.

- Work with a TPD claim expert – what we recommend is to seek help from TPD claims experts such as Curo Financial. We specialise in converting rejected claims to favorable decisions.

How much do you have to pay on a TPD insurance claim?

In general, a lump sum TPD payout is tax-free when:

- The policy is held under your name and paid outside of your Super, or

- Whether you are above the preservation age (depending on when you are born).

In case you are above the preservation age and your TPD policy is under your Supe, the taxable component of your TPD lump sum payout will be 22%. While the income stream withdrawals will be taxed at their marginal tax rate less the 15% tax offset.

Our free TPD Taxation Calculator can help you estimate how much tax you need to pay on your TPD payout.

Claiming your TPD through your Superannuation

To have a successful TPD claim through your super, you must review your policy’s TPD definition to understand exactly what you will need to evidence to the insurer. The overwhelming majority of TPD policies held within super have an Any Occupation definition of disability as an Own Occupation definition does not align with a condition of release for funds within super.

To maximise your TPD payout, you might want to check the impact of taxes upon withdrawal from your super. For an individual under the preservation age, it might be better to have your TPD payout as an income stream to save on taxes.

In processing your TPD claim through your Superannuation, you can adopt our seven-step process as your guide.

- Obtain TPD claim forms and a list of requirements

- Check your eligibility for TPD claim

- Gather medical evidence and documents

- Write a TPD claim supporting letter

- Submit your TPD claim

- Follow up with your insurer

- Be persistent even if your claim gets denied

Every step of the process requires careful execution as your insurer is keen on evaluating claims for fraud.

It is also important to note that the duration of the TPD claims process can take from several weeks to months depending on the complexity of the claim and the benefit amount. Working with a TPD claims expert would be highly beneficial in getting a higher chance of approval and for ease of process.

What to know about claiming TPD for your condition

TPD insurance aims to provide financial support in challenging times brought by disability from from illness or injury. Successful TPD claim gets an individual a lump sum benefit amount which can be used for medical expenses, home medical renovations, income support for living expenses, and others.

This section gives you an overview of what you should know in claiming a TPD benefit for your specific condition.

Mental Health

A staggering 42.9% of Australians, between the ages of 16 to 85 years old, had suffered from a mental health issue at some point in their life. However, there is a low percentage of approved TPD claims for mental health disorders due to a lack of medical proof to support the claim.

If you’re suffering from mental health (depression, anxiety disorders, post-traumatic stress disorder, bipolar disorder, and schizophrenia) and want to process a TPD claim, here’s what you can do:

- Get a medical diagnosis from a registered medical facility for your psychiatric disorder or mental health issue

- In the application, you must be able to prove that your mental health condition has caused a long-term disability that prevents you from performing your work.

- Know the date you have ceased from work due to your mental health condition.

Musculoskeletal disorders

People with severe conditions of osteoarthritis, rheumatoid arthritis, osteoporosis, scoliosis, or lupus can prevent a person from working permanently. Thus, making musculoskeletal disorders one of the leading causes of TPD claims in Australia.

The most common musculoskeletal issues leading to a TPD claim arise from a traumatic injury such as a car or workplace accident.

Cancer

Costs of cancer treatment in Australia can widely vary depending on the stage of the condition, whether it is in diagnosis, treatment, or recovery.

Typically, the out-of-pocket cost for cancer treatment ranges between hundreds of dollars to more than $10,000 considering whether the treatment is public or private. These can include:

- Fees for medical professionals

- Medical test results that are outside of the health system

- Hospital accommodation bills

- Medical equipment

- Over-the-counter prescription drugs

Another problem is when the cancer becomes severe and permanently disables the person from performing the work which reduces the households income.

This is where a successful TPD claim can be highly beneficial. It provides financial support not just to the person but to the whole family.

Here’s a quick guide to process a TPD claim for cancer:

- Eligibility: Check if your TPD insurance is still valid and review the definition of the eligibility requirement.

- Waiting period: Review your policy if there is a waiting period before you can process a claim.

- Evidence: Provide medical evidence that will support your medical condition such as medical or physician’s report. Also, include proof that your medical condition prevents you from working permanently.

- Claim process: Notify your insurer to obtain the necessary claims forms. Fill out the forms and attach a supporting letter that states your medical condition and how it affects your work in the long term.

Nervous system disorders

Neurological conditions such as a stroke, parkinson’s and alzheimer’s diseases, and dementia are some common nervous system disorders that permanently disable a person and prevent them from performing work.

TPD insurance usually covers these illnesses to provide financial support to an individual or to the family.

Get TPD claims advice from an insurance expert

The common reason for denied TPD claims is a failure to satisfy the insurers claims requirements or misrepresentation of documents. While it is possible, individually processing a TPD claim is a daunting task. There are steps that could be confusing.

Let us help you process your TPD claim. We have decades of experience providing TPD claims advice to Australians. We work with a goal of delivering the promise of your TPD insurance when you need it the most. Reach out to us.

Frequently asked questions

What are the most common reasons for claiming TPD insurance?

Mental health, musculoskeletal disorders, injuries from accidents, nervous system disorders, and cancer are the top reasons for claiming TPD insurance in Australia.

Does TPD insurance cover death?

No, TPD insurance doesn’t cover death. It offers financial support through a lump sum benefit in case of being unable to work permanently due to long-term disability from illness or injury.

However, in some insurance providers, it can be combined with death and life insurance coverage.

General Advice Disclaimer

General advice warning: The advice provided is general advice only and in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.

Speak with an expert adviser regarding your claim. Fill in the form below and one of our advisers will get in touch to assist you further.